Crafting a Financial Strategy With Bookkeeping 8656010254

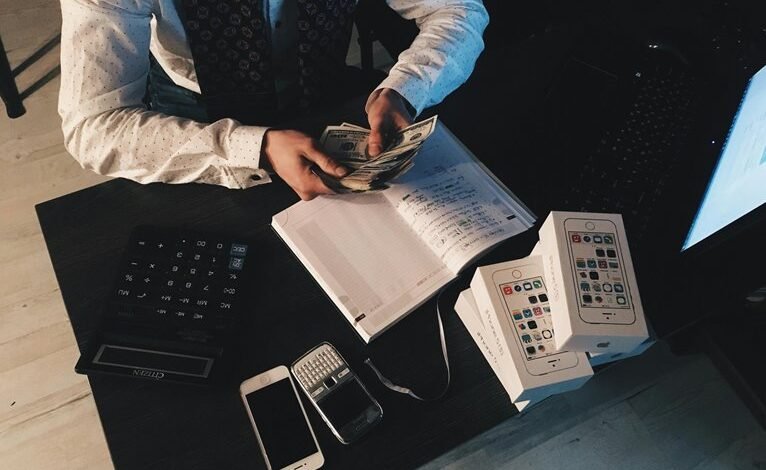

Crafting a financial strategy necessitates a solid foundation in bookkeeping. This discipline not only organizes transactions but also reveals critical insights into an organization's financial health. By understanding the nuances of revenue forecasting and cost management, businesses can position themselves strategically in the market. However, the effectiveness of these strategies hinges on the implementation of best practices in bookkeeping. What are the key components that can drive this alignment between financial data and strategic objectives?

Understanding the Role of Bookkeeping in Financial Strategy

Bookkeeping serves as the bedrock of an effective financial strategy, meticulously recording and organizing financial transactions to provide a clear picture of an organization's economic health.

The importance of bookkeeping lies in its ability to ensure financial accuracy, enabling informed decision-making.

Key Components of a Financial Strategy

A well-crafted financial strategy comprises several key components that work in concert to drive organizational success.

Central to this framework are cost management and revenue forecasting. Effective cost management ensures resources are allocated efficiently, while accurate revenue forecasting provides insights into future income streams.

Together, these elements facilitate informed decision-making, enabling organizations to adapt and thrive in a dynamic financial landscape, ultimately fostering long-term freedom and growth.

Leveraging Financial Data for Informed Decision-Making

While financial data serves as the backbone of strategic decision-making, organizations must skillfully analyze this information to derive actionable insights.

Effective data analysis facilitates decision optimization, enabling businesses to identify trends, allocate resources efficiently, and mitigate risks.

Implementing Best Practices in Bookkeeping for Long-Term Success

Implementing best practices in bookkeeping is essential for organizations aiming for long-term financial stability and growth.

Utilizing digital tools enhances accuracy and efficiency, while robust financial forecasting allows for informed strategic planning.

Conclusion

In conclusion, a robust bookkeeping framework serves as the bedrock for a sound financial strategy, subtly guiding organizations toward their long-term aspirations. By adeptly navigating the intricacies of financial data, businesses can illuminate their path to informed decision-making and strategic alignment. Embracing best practices in bookkeeping not only cultivates fiscal discipline but also fosters resilience in an ever-evolving marketplace, ultimately positioning organizations to thrive amidst uncertainty and achieve sustainable growth in a competitive landscape.