Navigating Complex Accounts With Bookkeeping 8603837250

Navigating complex accounts with bookkeeping requires a meticulous approach to ensure accuracy and compliance. Businesses must understand foundational principles while also adapting to advanced tools for revenue tracking and expense management. This balance not only aids in regulatory adherence but also uncovers potential savings. As organizations face evolving financial landscapes, the methods they choose can significantly impact their operational efficiency and strategic decision-making. The implications of these choices merit careful examination.

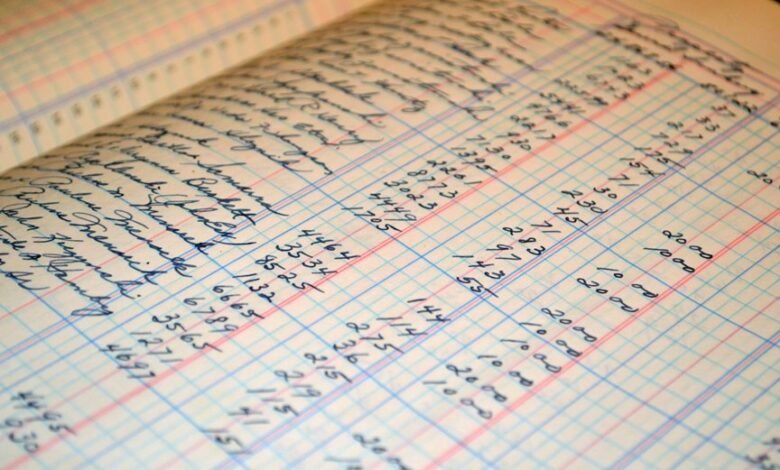

Understanding the Basics of Bookkeeping

Although bookkeeping may seem straightforward, it encompasses a range of systematic processes essential for accurate financial management.

Adhering to established accounting principles, it involves recording transactions, categorizing expenses, and preparing financial statements.

These elements not only ensure compliance but also provide a clear financial picture, empowering businesses to make informed decisions.

Mastery of these basics is crucial for fostering financial freedom and sustainability.

Streamlining Revenue Tracking

Accurate revenue tracking is a vital component of effective bookkeeping, building on the foundational principles previously outlined.

Streamlining this process involves leveraging sales analytics to identify trends and enhance revenue forecasting. By integrating automated tools and systems, businesses can simplify data collection, enabling more precise insights.

Ultimately, this efficiency empowers organizations to make informed decisions and pursue growth opportunities with confidence.

Managing Complex Expenses

Managing complex expenses requires a strategic approach, as organizations must navigate various costs that can obscure financial clarity.

Effective expense categorization is essential for accurately tracking expenditures, enabling insightful financial forecasting. By delineating costs into distinct categories, organizations can better assess their financial health, identify potential savings, and allocate resources more efficiently.

Ultimately, this fosters a greater sense of freedom in their financial decision-making.

Ensuring Regulatory Compliance

Ensuring regulatory compliance is a critical component of effective bookkeeping, as organizations must adhere to various laws and regulations that govern financial practices.

Regular regulatory audits are essential to identify discrepancies and ensure adherence to standards.

Furthermore, implementing compliance training equips staff with the necessary knowledge to navigate complex regulations, fostering an organizational culture that prioritizes transparency and accountability in financial reporting.

Conclusion

In the labyrinthine world of financial management, mastering bookkeeping principles emerges as a beacon of clarity amidst chaos. By meticulously categorizing every transaction, businesses transform their financial landscape into a well-orchestrated symphony of prosperity. This strategic approach not only unveils hidden savings but also fortifies compliance, propelling organizations toward a future where informed decisions blossom like vibrant flowers in a thriving garden. Embracing these practices can elevate an enterprise from mere survival to remarkable success, painting a masterpiece of fiscal health.