Understanding Financial Records in Bookkeeping 8653802220

Understanding financial records in bookkeeping is essential for any organization aiming for effective financial management. These records not only reflect an entity's economic health but also enhance transparency for stakeholders. By organizing various financial documents, businesses can streamline operations and improve accessibility to critical information. The implications of accurate bookkeeping extend beyond cash flow management, influencing strategic planning and long-term success. Yet, many organizations overlook key elements that could optimize their financial practices.

The Importance of Financial Records

Although often overlooked, financial records serve as the backbone of effective bookkeeping, providing essential insights into an organization's economic health.

These records foster financial transparency, allowing stakeholders to understand the true financial position. By ensuring accurate documentation, organizations enable informed decision making, empowering them to allocate resources wisely and strategize for future growth.

Thus, financial records are indispensable to operational success.

Types of Financial Documents

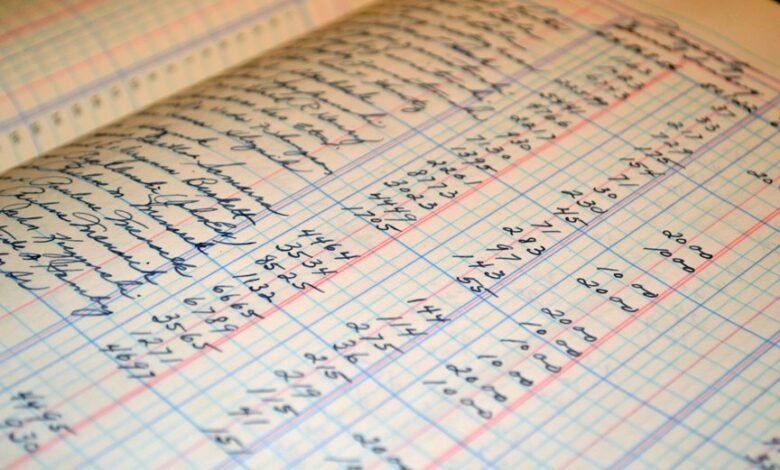

Financial records encompass a variety of documents that collectively provide a comprehensive view of an organization's financial activities.

Key types include invoices for effective invoice management, ensuring accurate billing and revenue tracking.

Additionally, expense tracking documents, such as receipts and statements, facilitate monitoring expenditures.

Together, these records support informed decision-making and promote financial transparency, critical for achieving operational efficiency and autonomy.

Organizing Your Financial Records

A systematic approach to organizing financial records is essential for maintaining clarity and accessibility within an organization.

Effective document storage strategies enhance record retention, ensuring that vital information is easily retrievable when needed.

Impact of Accurate Bookkeeping on Financial Health

Accurate bookkeeping serves as the foundation of an organization's financial health, directly influencing its ability to make informed decisions.

By ensuring precise cash flow management and effective expense tracking, businesses can identify financial trends, allocate resources wisely, and mitigate risks.

This clarity fosters strategic planning, ultimately enhancing profitability and sustainability, which empowers organizations to pursue growth and maintain financial freedom in a competitive landscape.

Conclusion

In the realm of financial management, accurate bookkeeping serves as the compass guiding a ship through turbulent waters. Just as a navigator relies on well-maintained charts to avoid hidden reefs, organizations depend on organized financial records to steer clear of fiscal pitfalls. The meticulous documentation of transactions not only illuminates the path to informed decision-making but also fortifies the vessel of economic health, ensuring it remains buoyant amidst the currents of change and uncertainty.